Can a Nursing Home Kick You Out for Non-Payment?

As a physical therapist specializing in senior care, I often encounter questions about the rights of nursing home residents. One of the most common and concerning inquiries I receive is whether a nursing home can evict a resident for non-payment. This is a complex issue that affects many families, and it’s crucial to understand the facts.

The short answer is: yes, a nursing home can legally discharge a resident for non-payment, but there are strict rules and procedures they must follow. In this comprehensive guide, I’ll explain everything you need to know about nursing home evictions due to non-payment, your rights as a resident or family member, and strategies to prevent or address these situations.

Understanding Nursing Home Rights

Before we discuss the specifics of non-payment evictions, it’s crucial to understand that nursing home residents have rights protected by federal and state laws. These rights are designed to ensure that residents are treated with dignity and respect, and that they receive proper care.

Key Rights of Nursing Home Residents

- Right to be Fully Informed: Residents have the right to be informed about services and fees before they enter the nursing home and throughout their stay. This includes the right to be notified about changes in services or charges.

- Right to Participate in Care Planning: Residents should be involved in creating and updating their care plan. They have the right to refuse treatments and medications.

- Right to Voice Grievances: Residents can voice complaints without fear of retaliation. The facility must promptly address these grievances.

- Right to be Free from Abuse and Neglect: This includes physical, verbal, sexual, and mental abuse, as well as involuntary seclusion and physical or chemical restraints.

- Right to Privacy and Confidentiality: This covers personal, financial, and medical information.

- Right to Manage Financial Affairs: Residents can manage their own money or choose someone they trust to do so.

- Right to Visitors: Residents can receive visitors of their choosing at any time, provided it doesn’t infringe on other residents’ rights.

- Right to Personal Property: Residents can keep and use personal belongings, including furnishings and clothing, as space permits.

- Right to Quality of Life: The facility must provide services and activities to attain or maintain the highest practicable physical, mental, and psychosocial well-being of each resident.

- Right to Transfer and Discharge: Residents have the right to remain in the facility and not be transferred or discharged unless certain conditions are met.

Understanding these rights is crucial when facing any issues with a nursing home, including potential discharge due to non-payment. It’s important to remember that these rights don’t disappear just because a resident is behind on payments.

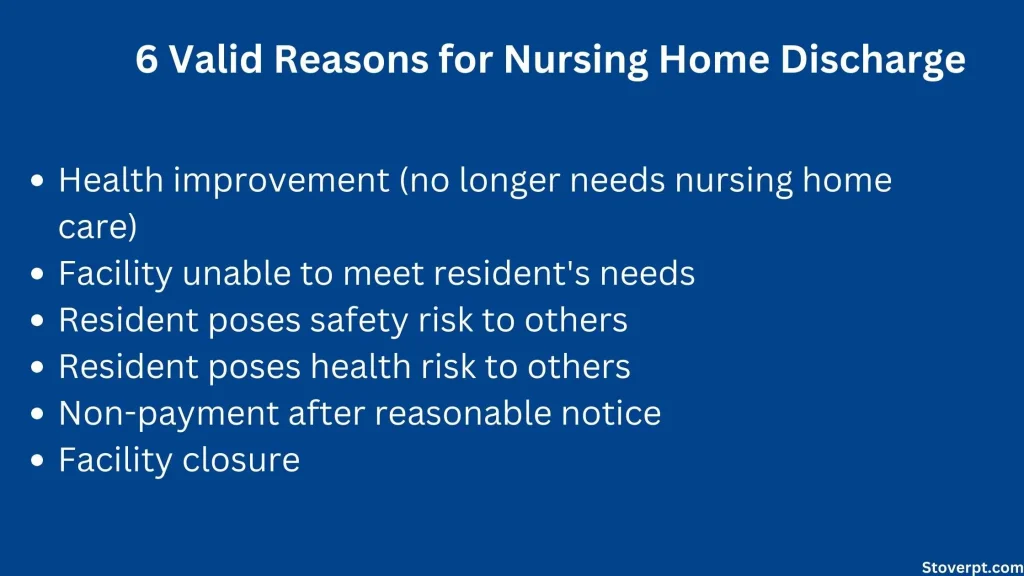

Reasons for Nursing Home Discharge

Nursing homes can’t just kick out residents whenever they want. There are only a few specific reasons why a nursing home can discharge a resident:

- Improvement in Health: If the resident’s health has improved to the point where they no longer need nursing home care, they can be discharged. This is actually a positive outcome, as it means the resident has regained enough independence to live in a less restrictive environment.

- Inability to Meet Resident’s Needs: If the facility cannot provide the care the resident needs, they may discharge the resident. This could happen if a resident develops a condition that requires specialized care the facility isn’t equipped to provide.

- Safety Risk: If the resident’s presence in the facility endangers the safety of other individuals, they can be discharged. This might occur if a resident exhibits consistently aggressive behavior that the facility cannot manage safely.

- Health Risk: Similarly, if the resident’s presence endangers the health of other individuals in the facility, discharge may be warranted. For example, if a resident has a highly contagious disease that the facility isn’t equipped to contain.

- Non-Payment: If the resident has failed to pay for their stay after reasonable notice, they can be discharged. This is the focus of our discussion today.

- Facility Closure: If the facility closes down, all residents will need to be discharged and transferred to other facilities.

It’s important to note that non-payment is indeed one of the reasons a nursing home can discharge a resident. However, as we’ll explore in more detail, there are many protections in place to prevent unfair evictions and ensure residents’ rights are respected.

The Non-Payment Issue

Non-payment is a serious concern for nursing homes. These facilities rely on payments to provide quality care, pay staff, and keep their doors open. When residents don’t pay, it can put a strain on the facility’s resources and potentially affect the quality of care for all residents.

However, nursing homes also have a responsibility to their residents. They can’t just throw someone out on the street because of a missed payment. There are rules and procedures they must follow, which we’ll discuss in detail later.

What Counts as Non-Payment?

Non-payment typically means that a resident has failed to pay the agreed-upon fees for their care. This could include:

- Monthly Charges: These are the basic fees for room and board. They often include standard care services.

- Care Level Charges: Some facilities have tiered pricing based on the level of care a resident needs. If a resident’s care needs increase, their charges may increase as well.

- Additional Services: Charges for extra services or amenities not included in the basic fee. This might include things like special dietary needs, personal laundry service, or private room upgrades.

- Co-payments: If a resident’s stay is partially covered by insurance or Medicaid, they may be responsible for co-payments.

- Spend-Down Amounts: For residents transitioning to Medicaid coverage, there may be a “spend-down” period where they’re responsible for paying a portion of their care costs.

It’s important to note that if Medicaid is paying for your care, the nursing home cannot discharge you for non-payment of fees that Medicaid doesn’t cover. This is a crucial protection for many residents.

The Complexity of Nursing Home Payments

Understanding nursing home payments can be challenging. Many residents rely on a combination of private funds, long-term care insurance, Medicare, and Medicaid to cover their care. Each of these payment sources has its own rules and limitations.

For example:

- Medicare generally only covers short-term stays in a skilled nursing facility, usually up to 100 days following a qualifying hospital stay.

- Medicaid can cover long-term care, but residents must meet strict financial eligibility requirements.

- Long-term care insurance policies vary widely in their coverage and may have waiting periods or coverage limits.

This complexity can sometimes lead to misunderstandings or disputes about what is owed, which is why clear communication with the facility about financial matters is crucial.

Legal Protections for Residents

While nursing homes can discharge residents for non-payment, there are several legal protections in place to prevent unfair evictions:

- Reasonable Notice: The nursing home must provide reasonable notice before discharging a resident. Federal law requires at least 30 days’ notice, but some states require more. For example, in California, nursing homes must provide 60 days’ notice for most discharges.

- Written Notice: The discharge notice must be in writing and include specific information:

- The reason for discharge

- The effective date of discharge

- The location to which the resident will be discharged

- Information about the resident’s right to appeal

- Contact information for the state’s long-term care ombudsman

- Safe Discharge: The nursing home must ensure that the discharge is safe and appropriate. They can’t just put a resident out on the street. The facility must arrange for a safe and orderly discharge to an appropriate location where the resident’s needs can be met.

- Appeal Rights: Residents have the right to appeal a discharge decision. During the appeal process, the resident generally has the right to stay in the facility. This is a crucial protection that gives residents time to resolve payment issues or find alternative arrangements.

- Readmission Rights: If a resident is hospitalized, they have the right to return to the nursing home if their Medicare coverage is still in effect. This is known as the right to “bed hold” and can protect residents from being discharged during a temporary hospitalization.

- Protection Against Retaliation: Nursing homes are prohibited from retaliating against residents who exercise their rights, including the right to appeal a discharge decision.

- Medicaid Pending Protection: In many states, if a resident has applied for Medicaid and their application is pending, the nursing home cannot discharge them for non-payment until the Medicaid decision is made.

These protections are designed to give residents time to address payment issues or find alternative arrangements if necessary. They also ensure that even if a discharge does occur, it’s done in a way that protects the resident’s health and safety.

The Discharge Process

If a nursing home decides to discharge a resident for non-payment, they must follow a specific process:

Provide Written Notice: The nursing home must give the resident (and their representative, if applicable) a written notice of discharge. This notice must include:

- The reason for discharge

- The effective date of discharge (which must be at least 30 days from the date of the notice)

- The location to which the resident will be discharged

- Information about the resident’s right to appeal

- Contact information for the state’s long-term care ombudsman

Develop a Discharge Plan: The nursing home must work with the resident and their family to develop a safe discharge plan. This plan should address:

- Where the resident will go after discharge

- How the resident will get there

- What care or services the resident will need after discharge

- How these care needs will be met in the new location

Ensure Safe Transfer: If the resident is being transferred to another facility, the nursing home must ensure that the new facility can meet the resident’s needs and is willing to accept them. They should provide the new facility with necessary information about the resident’s care needs.

Provide Necessary Information: The nursing home must provide the resident (or their new caregiver) with necessary information about their care needs, medications, and any follow-up care required. This should include:

- A complete list of current medications

- Any dietary restrictions

- Therapy needs

- Follow-up medical appointments

Assist with Transitions: The nursing home should help coordinate the resident’s move, including arranging for transportation if necessary.

Document the Process: The facility should document all steps of the discharge process in the resident’s medical record.

It’s important to remember that even if a resident is being discharged for non-payment, they still have the right to proper care and a safe discharge. The nursing home’s responsibility to provide quality care doesn’t end until the resident has been safely transferred to their new location.

Appealing a Discharge Decision

If a resident believes they’re being unfairly discharged, they have the right to appeal the decision. Here’s how the appeal process typically works:

Request a Hearing: The resident or their representative must request a hearing within a certain timeframe (usually 10 days) after receiving the discharge notice. This request should be made in writing to the state agency responsible for these hearings.

Continue Residence: In most cases, the resident can stay in the facility during the appeal process. This is a crucial protection that allows residents to contest unfair discharges without immediately losing their home.

Prepare for the Hearing: The resident should gather all relevant documents, including:

- The discharge notice

- Medical records

- Financial records

- Any correspondence with the nursing home about the payment issue

Seek Assistance: Residents can seek help from the local long-term care ombudsman or a legal aid attorney. These professionals can provide valuable guidance and may even be able to represent the resident at the hearing.

Attend the Hearing: A hearing officer will listen to both sides and make a decision. The hearing may be held in person or over the phone. The resident can present evidence and have witnesses testify on their behalf. The nursing home will also present its case for why the discharge is necessary.

Receive a Decision: The hearing officer will make a decision based on the evidence presented. This decision should be provided in writing. If the decision is in the resident’s favor, they can stay in the facility.

Further Appeals: If the hearing decision is not in the resident’s favor, they may have the option to appeal to a higher authority, such as a state court. The process for this varies by state.

Remember, the burden of proof is on the nursing home to show that the discharge is necessary and appropriate. They must demonstrate that they have met all legal requirements for the discharge and that it’s in the best interest of the resident.

During the appeal process, it’s crucial to continue working on resolving the payment issue if possible. Even if the appeal is successful, the underlying financial problem will need to be addressed to prevent future discharge attempts.

Preventing Non-Payment Situations

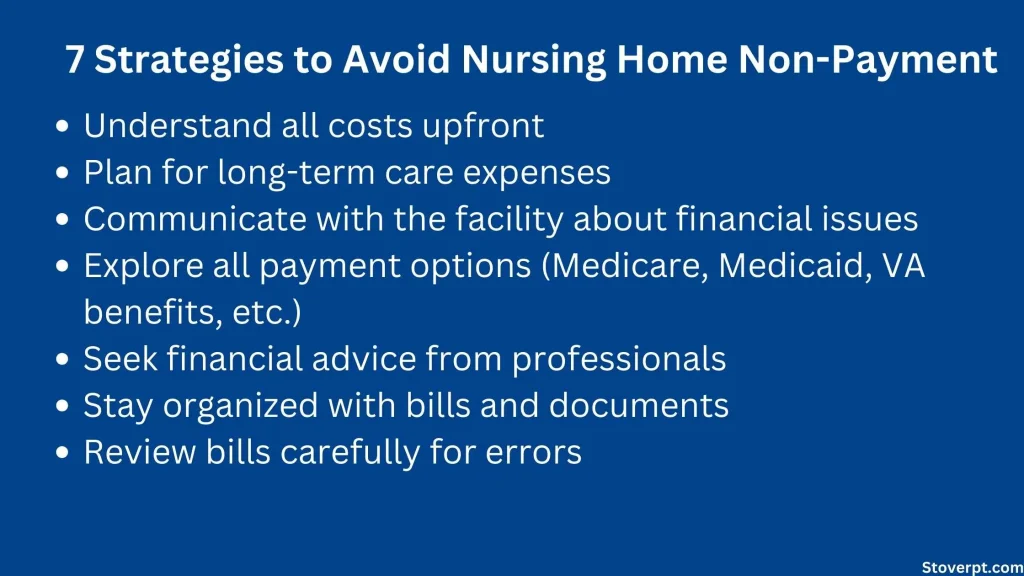

The best way to avoid being discharged for non-payment is to prevent payment issues from arising in the first place. Here are some strategies I recommend:

Understand Costs Upfront: Before moving into a nursing home, make sure you fully understand all the costs involved. Ask for a detailed breakdown of charges, including:

- Basic daily rate

- Charges for different levels of care

- Additional fees for services or amenities

- Potential future cost increases

Plan for Long-Term Costs: Long-term care is expensive. It’s important to plan ahead and consider options like:

- Long-term care insurance

- Medicaid planning with an elder law attorney

- Setting aside savings specifically for long-term care

- Exploring veterans benefits if applicable

Communicate with the Facility: If you’re having trouble making payments, don’t ignore the problem. Talk to the nursing home’s financial office as soon as possible. They may be able to:

- Work out a payment plan

- Help you apply for Medicaid or other assistance programs

- Suggest other resources for financial help

Explore All Payment Options: Look into all possible sources of payment, including:

- Medicare (for short-term stays)

- Medicaid

- Veterans benefits

- Private insurance

- Reverse mortgages

- Life insurance policy conversions

Seek Financial Advice: Consider consulting with a financial advisor or elder law attorney who specializes in long-term care planning. They can help you:

- Understand your options

- Plan for future care needs

- Structure your assets in a way that may help you qualify for Medicaid if needed

Stay Organized: Keep all financial documents, bills, and correspondence from the nursing home in one place. This can help you:

- Catch and address any billing errors quickly

- Keep track of payment due dates

- Have necessary documentation if you need to apply for assistance programs

Review Bills Carefully: Always review your nursing home bills carefully. Look for any unexpected charges or errors. If you don’t understand something, ask for clarification.

Consider a Care Manager: A professional care manager can help coordinate care and navigate financial issues. They may be able to identify resources or strategies you haven’t considered.

Plan for Spend-Down: If you’re likely to need Medicaid in the future, work with an elder law attorney to plan for the Medicaid “spend-down” process. This can help you protect some assets while becoming eligible for Medicaid.

By being proactive about financial planning and communication, you can often avoid reaching the point where non-payment becomes an issue.

Alternative Payment Options

If you’re struggling to pay for nursing home care, there are several alternative payment options to consider:

- Medicaid: If you’ve exhausted your personal resources, you may be eligible for Medicaid, which covers nursing home care for those who qualify. Remember:

- Eligibility requirements vary by state

- There’s often a “look-back” period to prevent people from giving away assets to qualify

- You may need to “spend down” your assets to qualify

- Medicare: While Medicare doesn’t cover long-term nursing home care, it can cover short-term stays under certain conditions:

- Up to 100 days of skilled nursing care after a qualifying hospital stay

- The first 20 days are fully covered; days 21-100 require a daily co-payment

- Veterans Benefits: If you’re a veteran or the spouse of a veteran, you may be eligible for VA benefits that can help cover nursing home costs:

- The Aid and Attendance benefit can provide additional monthly payments

- Some state veterans homes provide nursing home care to eligible veterans

- Long-Term Care Insurance: If you have a long-term care insurance policy, it may cover some or all of your nursing home costs:

- Check your policy’s daily benefit amount and how long benefits last

- Understand any waiting periods before benefits kick in

- Reverse Mortgage: If you own a home, a reverse mortgage might provide funds to pay for nursing home care:

- Only available if one spouse remains living in the home

- Can provide a lump sum or ongoing payments

- The loan becomes due when the last borrower moves out or passes away

- Life Insurance Conversion: Some life insurance policies can be converted to pay for long-term care:

- Some policies have a built-in option to use the death benefit for long-term care

- You might be able to sell your policy for a “life settlement” to pay for care

- Payment Plans: Some nursing homes may be willing to work out a payment plan if you’re temporarily unable to pay the full amount:

- This might involve spreading payments over a longer period

- You may need to provide financial information to qualify

- Charitable Organizations: Some non-profit organizations provide financial assistance for seniors in need:

- These are often limited and may have specific eligibility requirements

- Your local Area Agency on Aging might be able to point you to local resources

- Family Care Agreements: In some cases, family members might be able to pool resources to cover care costs:

- This should be done with a formal agreement to avoid misunderstandings

- Consider consulting with an elder law attorney to set this up properly

Remember, it’s important to explore all these options before letting a non-payment situation escalate to the point of potential discharge. Each option has its own pros and cons, and what works best will depend on your individual situation.

When Discharge is Unavoidable

Sometimes, despite best efforts, discharge due to non-payment may be unavoidable. If this happens, it’s important to focus on ensuring a safe and appropriate discharge. Here’s what you should do:

- Cooperate with Discharge Planning: Work with the nursing home staff to develop a safe discharge plan. This includes:

- Finding appropriate alternative housing

- Arranging for necessary care and services

- Ensuring all medical information is transferred to new caregivers

- Explore Community Resources: Look into community-based services that might be able to provide care or assistance after discharge:

- Home health care services

- Meal delivery programs

- Adult day care centers

- Transportation services for medical appointments

- Consider Other Facilities: If nursing home care is still necessary, look into other facilities that might be more affordable or accept Medicaid:

- State-run nursing homes often have lower rates

- Some non-profit facilities offer sliding scale fees

- Assisted living facilities might be a less expensive option if appropriate

- Seek Legal Advice: If you believe the discharge is unfair or illegal, consider consulting with an elder law attorney:

- They can review the discharge notice and process

- They might be able to negotiate with the facility

- They can represent you in an appeal if necessary

- Contact the Ombudsman: Your state’s long-term care ombudsman can provide information and advocacy services:

- They can explain your rights

- They might be able to mediate between you and the facility

- They can provide information about other resources

- Plan for Medication Management: Ensure you have a plan for obtaining and managing necessary medications after discharge:

- Get copies of all prescriptions

- Understand how to take each medication

- Arrange for a supply of medications to last until you can see your doctor

- Arrange for Follow-Up Care: Make sure you have appointments scheduled with your doctors after discharge:

- This is especially important if you have chronic conditions

- You may need new referrals if you’re moving to a new area

- Gather Personal Belongings: Make sure you have a plan to collect and transport all personal belongings:

- The facility should provide an inventory of your belongings

- Arrange transportation for larger items if necessary

Remember, even if you’re being discharged, you still have rights. The nursing home must ensure that you’re discharged to a safe and appropriate setting.

Things to avoid with Dementia patients

Resident Rights During Discharge

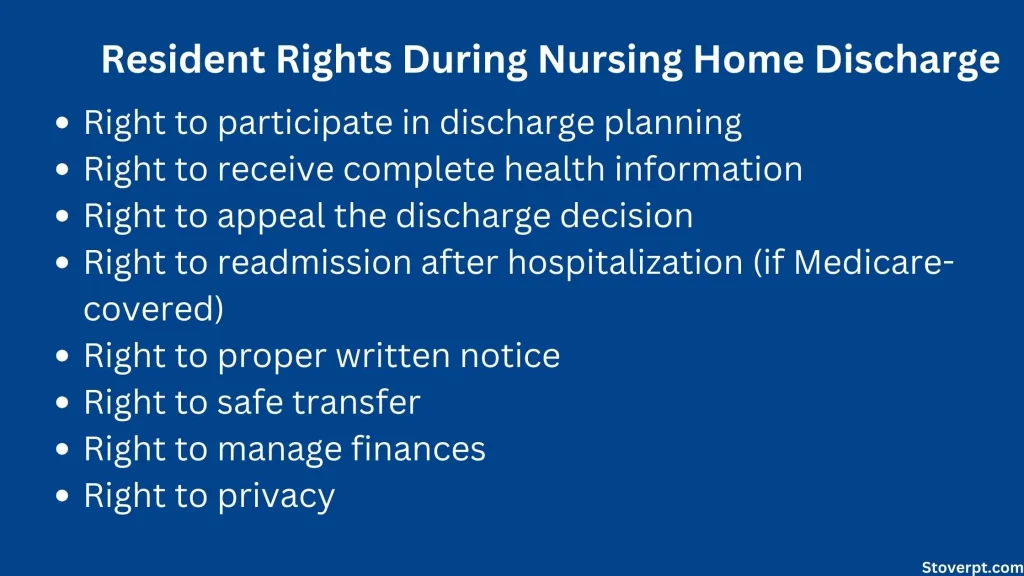

Even when a discharge is happening, residents still have important rights:

- Right to Participate: You have the right to participate in planning your discharge and deciding where you’ll go. The facility should involve you in every step of the process.

- Right to Information: You have the right to receive complete information about your health status, care needs, and medications. This includes:

- A complete list of your current medications and dosages

- Information about any follow-up care you’ll need

- Contact information for your doctors

- Right to Appeal: You have the right to appeal the discharge decision, even after the discharge has occurred. The appeal process should be explained in your discharge notice.

- Right to Readmission: If you’re sent to a hospital, you generally have the right to return to the nursing home if your Medicare coverage is still in effect. This is known as your “bed hold” right.

- Right to Proper Notice: You have the right to receive proper written notice of the discharge, including:

- The reason for discharge

- The effective date

- The location of discharge

- Information about your right to appeal

- Right to Safe Transfer: You have the right to a safe and orderly transfer or discharge. This includes:

- Preparation and orientation to ensure a safe transfer

- Assurance that the new location can meet your needs

- Right to Manage Finances: You have the right to manage your own financial affairs or to choose someone you trust to do so for you.

- Right to Privacy: Your financial and medical information should be kept confidential during the discharge process.

Understanding and asserting these rights can help ensure that even if a discharge occurs, it’s done in a way that protects your health and well-being.

Finding a New Facility

If you need to find a new nursing home after being discharged, here are some steps to follow:

- Research Options: Use resources like Medicare’s Nursing Home Compare tool to research facilities in your area. Look at:

- Overall star ratings

- Health inspection results

- Staffing ratings

- Quality measure ratings

- Visit Facilities: If possible, visit potential new homes to get a feel for the environment and level of care:

- Observe how staff interact with residents

- Check the cleanliness of the facility

- Ask about activities and services offered

- Check for Medicaid/Medicare Certification: If you’re relying on these programs, make sure the new facility is certified:

- Not all nursing homes accept Medicaid

- Medicare certification is important for short-term rehabilitation stays

- Review Inspection Reports: Look at state inspection reports to see if the facility has any serious violations:

- These reports should be available on request

- Pay attention to any recurring issues

- Ask About Costs: Make sure you understand all costs upfront to avoid future payment issues:

- Get a breakdown of all charges

- Ask about any potential additional fees

- Consider Location: Choose a location that’s convenient for family and friends to visit:

- This can have a significant impact on quality of life

- Consider proximity to your doctors if you’ll be leaving the facility for appointments

- Check Staff Ratios: Ask about staff-to-resident ratios to ensure adequate care:

- Higher ratios generally mean more individualized care

- Ask about staff turnover rates

- Inquire About Specialized Care: If you have specific medical needs, make sure the facility can accommodate them:

- This might include things like dialysis, ventilator care, or memory care

- Review the Contract: Before agreeing to move in, carefully review the admission contract:

- Consider having a lawyer or trusted advisor review it with you

- Make sure you understand all terms and conditions

Remember, finding the right facility is crucial for your health and happiness. Don’t rush the decision if you can avoid it.

Things to do with dementia patients

The Role of Family and Advocates

Family members and other advocates can play a crucial role in preventing and addressing non-payment issues:

- Financial Management: Family members can help manage finances and ensure bills are paid on time:

- This might involve setting up automatic payments

- Regularly reviewing bills and financial statements

- Helping to apply for benefits or assistance programs

- Communication: They can serve as a point of contact with the nursing home, especially if the resident has cognitive impairments:

- Attending care plan meetings

- Discussing any concerns with staff

- Keeping other family members informed

- Advocacy: Family members can advocate for the resident’s rights and help navigate the appeal process if necessary:

- Understanding and explaining the resident’s rights

- Helping to gather necessary documentation

- Accompanying the resident to hearings or meetings

- Support: They can provide emotional support during what can be a stressful situation:

- Regular visits

- Helping the resident stay connected with friends and community

- Assisting with decision-making

- Alternative Arrangements: If discharge is necessary, family members can help find and arrange alternative living situations:

- Researching other facilities

- Exploring in-home care options

- Preparing their own home if the resident will be moving in with family

- Coordination of Care: Family members can help ensure continuity of care:

- Keeping track of medical appointments

- Communicating with healthcare providers

- Monitoring medications

- Legal Support: They can help secure legal representation if needed:

- Finding an elder law attorney

- Helping to prepare for legal proceedings

- Attending meetings with lawyers

If you’re a family member of a nursing home resident, stay involved and informed about their care and financial situation. Your support can make a big difference.

Financial Planning for Long-Term Care

To avoid non-payment issues in the first place, it’s crucial to plan ahead for the costs of long-term care. Here are some strategies to consider:

- Long-Term Care Insurance: This type of insurance can help cover nursing home costs:

- It’s best to purchase it when you’re younger and healthier

- Premiums can be expensive, so weigh the costs and benefits carefully

- Some policies offer inflation protection to keep up with rising care costs

- Medicaid Planning: Work with an elder law attorney to structure your assets in a way that may help you qualify for Medicaid if needed:

- This might involve setting up trusts

- Be aware of the five-year “look-back” period for asset transfers

- Understand the difference between countable and exempt assets

- Savings: Start saving early for potential long-term care needs:

- Consider setting up a dedicated savings account or investment portfolio

- Take advantage of tax-advantaged savings options like Health Savings Accounts (HSAs)

- Home Equity: Consider options like reverse mortgages or selling your home to pay for care:

- Understand the pros and cons of each option

- Consider the impact on your spouse if they’re still living in the home

- Life Insurance Conversion: Some life insurance policies can be converted to pay for long-term care:

- This might involve accelerated death benefits or life settlements

- Understand the tax implications of these options

- Veterans Benefits: If you’re a veteran, explore VA benefits that might help cover long-term care costs:

- The Aid and Attendance benefit can provide additional monthly income

- Some state veterans homes provide nursing home care

- Family Care Agreements: Consider formal agreements where family members provide care in exchange for payment or future inheritance:

- These should be carefully structured to avoid gift tax issues

- Consider the impact on family dynamics

- Annuities: Some types of annuities can provide a stream of income to pay for long-term care:

- Understand the terms and potential penalties

- Consider whether the annuity is Medicaid-compliant if you might need Medicaid in the future

- Retirement Account Planning: Consider how your retirement accounts can be used to fund long-term care:

- Understand the tax implications of withdrawals

- Consider converting traditional IRAs to Roth IRAs for more tax-efficient withdrawals

Remember, the earlier you start planning, the more options you’ll have available. It’s never too early to start thinking about how you’ll pay for potential long-term care needs.

Common Myths About Nursing Home Evictions

There are several misconceptions about nursing home evictions that I’d like to address:

- Myth: Nursing homes can evict residents anytime they want. Fact: Nursing homes can only discharge residents for specific reasons outlined in federal law. These include non-payment, but also include reasons like the facility’s inability to meet the resident’s needs or if the resident poses a danger to others.

- Myth: If you can’t pay, you’ll be immediately kicked out. Fact: Nursing homes must provide proper notice and follow a specific process before discharging a resident. This process includes providing at least 30 days’ notice and developing a safe discharge plan.

- Myth: Once you’re on Medicaid, you can never be evicted for non-payment. Fact: While Medicaid does provide significant protection, you could still face discharge if you fail to pay the portion you’re responsible for, such as a monthly spend-down amount or co-pay.

- Myth: Appealing a discharge decision is too complicated for most people. Fact: While the process can be complex, resources like ombudsmen and legal aid services are available to help. Many residents successfully appeal discharge decisions.

- Myth: Nursing homes can discharge residents to homeless shelters if they can’t pay. Fact: Nursing homes must ensure that discharges are to safe and appropriate settings that can meet the resident’s needs. A homeless shelter would not be considered appropriate for someone needing nursing home level care.

- Myth: If you leave the nursing home for a hospital stay, the facility doesn’t have to readmit you. Fact: If you’re eligible for Medicare or Medicaid, the nursing home must hold your bed for a certain period (which varies by state) and allow you to return after a hospital stay.

- Myth: Nursing homes can refuse to accept Medicaid once your private funds run out. Fact: If a nursing home is Medicaid-certified, they cannot discharge you solely because you’re switching from private pay to Medicaid.

- Myth: Family members are legally responsible for nursing home bills. Fact: Generally, family members are not responsible for nursing home bills unless they’ve signed a contract accepting responsibility. However, there are some exceptions, such as in cases of financial exploitation.

Understanding these facts can help you better advocate for yourself or your loved ones in a nursing home setting.

Case Studies: Real-Life Scenarios

To better understand how these issues play out in real life, let’s look at a few case studies:

- The Smith Family: Mrs. Smith had been in a nursing home for two years when her savings ran out. The family applied for Medicaid, but there was a delay in processing the application. The nursing home issued a discharge notice. The family contacted their local ombudsman, who helped them file an appeal. During the appeal process, the Medicaid application was approved, and Mrs. Smith was able to stay in the facility. Lesson: Don’t wait until funds are completely exhausted to apply for Medicaid. Start the process early to avoid gaps in coverage.

- Mr. Johnson: Mr. Johnson’s son had been managing his finances but fell behind on payments due to his own financial difficulties. The nursing home issued a discharge notice. The family worked with the facility’s billing department to set up a payment plan. They also consulted with an elder law attorney who helped them apply for VA benefits, as Mr. Johnson was a veteran. With the payment plan in place and the promise of future VA benefits, the nursing home agreed to rescind the discharge notice. Lesson: Communication is key. Many facilities are willing to work with families to find solutions if they’re kept informed of the situation.

- The Garcia Family: Mrs. Garcia was discharged from her nursing home due to non-payment. The family didn’t realize they had the right to appeal. They struggled to find appropriate care for Mrs. Garcia, and her health declined. Eventually, they learned about their rights from a social worker and were able to file a late appeal. While Mrs. Garcia was readmitted to the nursing home, the family wishes they had known their rights earlier. Lesson: Know your rights. The right to appeal is crucial, and it’s important to act quickly when you receive a discharge notice.

- Mr. Thompson: Mr. Thompson’s nursing home issued a discharge notice when his Medicaid application was denied due to excess assets. The family worked with an elder law attorney to set up a Medicaid-compliant annuity, which helped Mr. Thompson qualify for Medicaid. However, this process took time. The family filed an appeal of the discharge notice, which gave them the time needed to complete the Medicaid planning and application process. Lesson: Medicaid planning can be complex. Working with an experienced elder law attorney can help navigate these complexities and find solutions.

These case studies illustrate the importance of understanding your rights, communicating with the facility, seeking help when needed, and planning ahead for long-term care costs.

State-Specific Regulations

While federal law provides a baseline of protections for nursing home residents, many states have additional regulations that provide extra safeguards. Here are some examples of state-specific rules:

- California: Requires 60 days’ notice for most discharges, rather than the federal minimum of 30 days.

- New York: Has specific rules about the content of discharge notices and requires facilities to hold beds for Medicaid recipients hospitalized for up to 15 days.

- Florida: Provides residents the right to request a state fair hearing to challenge a discharge, in addition to the federal appeal rights.

- Illinois: Requires nursing homes to offer the resident the option of staying in the facility and paying privately before issuing a discharge notice for non-payment of Medicaid co-pays.

- Massachusetts: Has detailed regulations about the discharge planning process, including requirements for facilities to document their efforts to find appropriate alternative placements.

It’s important to familiarize yourself with the specific regulations in your state. Your local long-term care ombudsman or state health department can provide information about state-specific protections.

Resources for Further Assistance

If you’re facing issues related to nursing home discharge due to non-payment, there are several resources available to help:

- Long-Term Care Ombudsman: Every state has a Long-Term Care Ombudsman program that can provide information about your rights and assist with resolving problems. Find your local ombudsman at The National Consumer Voice for Quality Long-Term Care.

- Legal Aid: Many areas have legal aid organizations that provide free legal assistance to seniors. The Legal Services Corporation can help you find local resources.

- Eldercare Locator: This service provided by the U.S. Administration on Aging can help you find local resources for older adults and their families. Visit Eldercare Locator or call 1-800-677-1116.

- National Academy of Elder Law Attorneys: If you need to find an elder law attorney, this organization provides a directory of attorneys specializing in elder law. Visit NAELA.

- Medicare.gov: Provides information about nursing home rights and how to file a complaint. Visit the Nursing Home Compare tool to research and compare nursing homes.

- Medicaid.gov: Offers information about Medicaid eligibility and long-term care coverage. Each state’s Medicaid agency can provide state-specific information.

- National Center on Law & Elder Rights: Provides legal resources and training for advocates working with older adults. While they don’t provide direct services to individuals, their website has valuable information: NCLER.

Remember, you don’t have to navigate these complex issues alone. Don’t hesitate to reach out for help if you’re facing a potential discharge or having trouble paying for nursing home care.

Conclusion

Dealing with the possibility of being discharged from a nursing home due to non-payment can be stressful and overwhelming. However, it’s important to remember that you have rights and there are resources available to help you.

The key takeaways from this post are:

- Yes, nursing homes can legally discharge residents for non-payment, but they must follow strict rules and procedures.

- Residents have the right to proper notice, a safe discharge plan, and the ability to appeal the decision.

- There are many alternative payment options to explore before reaching a non-payment situation.

- Planning ahead for long-term care costs is crucial to avoiding payment issues.

- Family members and advocates can play an important role in preventing and addressing non-payment problems.

- State-specific regulations may provide additional protections beyond federal law.

If you’re facing a potential discharge due to non-payment, don’t panic. Reach out to the nursing home’s financial office, contact your local long-term care ombudsman, and consider seeking legal advice. Remember, you have rights, and there are people and organizations ready to help you navigate this challenging situation.

Long-term care planning is complex, but understanding your rights and options is the first step towards ensuring quality care for yourself or your loved ones. Stay informed, plan ahead, and don’t hesitate to seek help when you need it.